Setting up a tech support support business in India comes with many challenges due to high risk associated with disputes arising due to conflict between the parties. One of the biggest issue is finding a high risk payment gateway for tech support business.

Finding a merchant account provider for your tech business is a huge difficulty. Money issues come later, the very first issue rests in finding a provider. Due to many fraudulent cases there are a few reliable merchant account providers for high risk payment gateways.

Why is it difficult to get high risk payment gateway for tech support business

The tech industry has witnessed many fraudulent cases and spam in the tech industry. Even Microsoft is concerned about such issues. There are innumerable blogs on Microsoft’s website for the same.

At the same time Tech support businesses generally have higher chargeback possibility.

Therefore, payment gateways classify tech support business payments as high risk. If you a tech support business, you will get classified as high risk business and you will be subjected to unconventional processing agreements. Naturally leading payment gateways may not like to offer your their services.

What is High risk payment processing?

Payment processing companies such as Paypal, Stripe process several types of payments. Depending on the type of industry they define such payments as:

- High risk payments

- Low risk payments

The categorisation of payments is driven by the past history of fraudulent charges, chargebacks, cancelled orders and many other factors. If you are working in an industry with such scenario, it could be classified as a high risk industry.

Most of the Payment processers refer business into high-risk category with merchants’ ratio (both real and anticipated) of chargebacks, merchandise returns or your payment processing history.

Therefore not all payment gateways support high risk payment processing.

Typical High risk Payment Industries

Though this categorisation can differ from country to country and among payment processors, here are some typical high risk payment industries (1, 2):

- Adult Content

- Antique & Collectables

- Apparel Sales

- Auto Parts & Accessories

- Beer, Wine & Liquor Sales

- Binary Options

- Bitcoin Merchants

- Computer Hardware

- Credit Repair

- Currency Exchange

- Dating

- Debt Collection

- Debt Consolidation

- Domain Registration

- Downloadable Software

- eCigarettes

- Educational Software

- Electronics Business

- Financial Aid Consulting

- Financial Services

- Fine & Cosmetic Jewelry

- Forex Trading

- Furniture Sales

- Health and Wellness Products

- Insurance Providers

- ISP and Hosting Services

- Magazine Subcriptions

- Mobile App Software

- Money Transfer

- Nutraceuticals

- Online Gaming

- Pawn Shops & Pawnbrokers

- Payday & Title Loans

- PC Tech Support

- Pet Shops & Supply Stores

- Prepaid Phone Cards (contact us)

- Self Storage Business

- Software Downloads (contact us)

- SEO / SEM / Web Design / Dev

- Travel

Tech Support Payment Gateway: A Big Issues in India and several other Countries

This is the reason why many tech support companies operating from India and serving the U.S. and Canadian customers, face a lot of issues getting the reliable payment gateway.

Some of these companies needs to provide documentation for processing transaction, however at times such documents are not available with a startup. Therefore, tech support businesses in India and globally are on a constant lookout for high risk payment gateway providers.

Most of the Indian payment gateways does not support currencies other then Indian rupee, therefore startups are on a constant lookout for offshore payment gateways.

Need a payment gateway for tech support: Impact of your Business Model on cost

Well, if you are a high risk merchant, it has a huge impact on TDR & other charges. Here is what you should expects on High risk Payment Gateway for Tech Support Business:

- Pay higher accounts setup fees

- Increase processing fees (TDR).

- Pay chargeback fees

- Keep rolling reserve towards the live merchant account. PG may use that money to offset any chargebacks from the acquiring bank.

How to get payment gateway providers for tech support

Well, if you are a high-risk business here is what you should do:

- Ensure that you have a formal organisation structure.

- Compile all the documents such as company formation certificate, tax registration, income tax registration, address proof, bank records and cancelled cheque.

- Compile documents of the principal account manager along with his documents such as identity proof, income tax registration and company authorisation that you can operate the account.

- Identify a payment processor that specialises in high risk payment gateway for tech support business. Such payment processor have technology and mechanism to:

- Monitor suspicions transactions

- Identify potential threats

- Manage chargebacks to reduce your risk on daily basis.

Top 10 High Risk Payment Gateway for Tech Support Business

Once you identify a suitable high risk payment gateway for tech support business you will be able to run your business without any challenges. As these payment gateways have the expertise and technology to manage your business requirements you can draw clear benefits for your online business. You will have a healthy account and sustainable business.

Third party Payment Gateway for Tech Support Business in India: INR Payments

Here are some Payment gateway providers who support high risk payment processing:

1 Instamojo

Instamojo helps you in,

- Collecting payments

- Manage accounting

- Resolve Disputes

- Manage Data

Payment charts help you in acknowledging your growth chart. Instamojo is extremely user-friendly and one of the best services available out there at zero costing in the beginning and zero maintenance cost. Features of Instamojo

- Domestic credit card supported

- Initial set up fees- zero

- Annual Maintenance Charges- zero

- Minimum annual business requirement

- Applicable Fee per transaction- minimal

2 PayUMoney

Payumoney is one of the most trusted and easy getaway plan. It also has options for SMB Businesses.

● Go live in minutes

● Get settlements in preferred bank accounts

● Wide range of payment options

● One business spot- easy getaway, complete management

Set-up fee: ZERO

Maintenance Fee: ZERO

Transaction Fee: 2% (How less is it)

3 EBS

EBS is owned by a France based Ingenio Group which is a global leader in payment processing services. Although there are mixed reviews towards this gateway but it has been around for long and is considered fairly reliable. They have a fairly fair price for small and medium businesses.

● Fraud and Risk Prevention

● Multilingual Page and Responsive Web Design

● Turbo Checkout

● Advanced Analytics

● Stable and Highly Secured Transaction

Set up fee- From ₹4799- ₹23999 based on plan

Annual Maintenance Fee- ₹2400

Transaction Fee- From 1.25% to 2.75%

High Risk Payment Gateway for Tech Support in India

4 CC Avenue

CC Avenue can help process multiple currencies and allows you to collect payments from 27 countries all across the world. It has a multilingual checkout page and is easily customisable- a design that complements your website.

-Efficient Marketing Tools

-Multilingual in approach

-CC Avenue S.N.I.P. (Social Network In-Stream Payments)- helps you monetize even your social network platform.

-Initial Setup Fee: Zero

-Annual maintenance Charge for a Startup account: Rs 1200

-Transaction Fee per Transaction: Variable fee below

-Key Features of CCAvenue payment Gateway are,

● International Payment / Credit card Support: Supported on CCAvenues. Your eCommerce store can represent your product pricing in any number of currencies. Your customers can check-out on the CCAvenue payment option page using their desired currency with Multi-Currency payment Gateway that supports 27 foreign currencies.

● Multi- currency approach, payments from all across the world

International Payment Gateway for Tech Support business in India

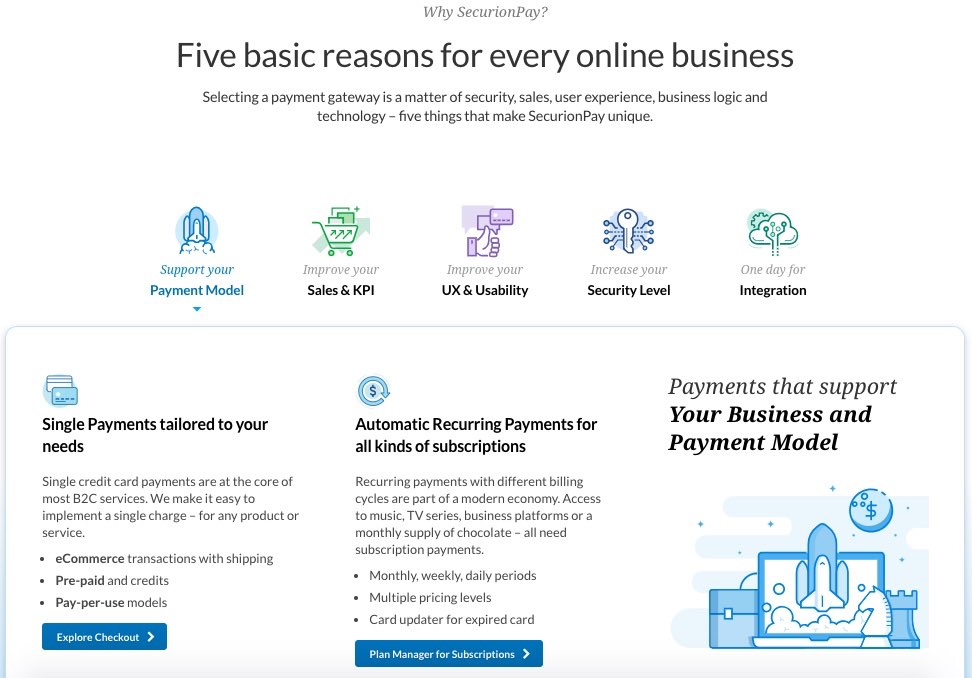

5 SecurionPay

Securionpay offers easy to integrate High Risk Payment Gateway for Tech Support Business. Their pricing is quite simple (TDR2.95% + Euro 0.25), account setup fee is nil. and their integration is fast and quick. Securionpay could be a perfect payment gateway for tech support in uk as they are based in Europe.

6 Soar Payments

They have a very personalised approach, they understand and cater to the unique needs of the high risk merchants and industries. SoarPay is headquartered in Houston, Texas. The company provides credit card processing services for businesses of all sizes. It has been rated as #1 High Risk Merchant Services Provider in 2015, and 2016.

SoarPay offers all-in-one merchant accounts include everything a high risk or offshore merchant needs to process successfully, including debit and credit card processing, check processing (ACH), payment gateways, and chargeback management services.

● Swiped Fees: 0.1 – 0.4% Plus Interchange + $0.15 per transaction

● Monthly Fees: $10 per month

Find their online application here.

7 PayPal

A lot of people aren’t aware of the fact that PayPal undertakes third party processing in the high risk business. It has various features that would help sort your problems of transaction and trust.

Features:

- Less Paperwork: Fill the application online and get it approved in minutes.

- Easy Online Application

- No set-up Fee

- Quick approval from all vendors

- No fixed monthly fees: The sales aren’t regular and so is the PayPal fee policy. You have to pay per transaction.

- High Fraud Protection Scheme

US Payment Gateway for Tech Support in India

Here are some leading USA Payment Gateway for Tech Support business in India:

5 SecurionPay

Securionpay offers easy to integrate High Risk Payment Gateway for Tech Support Business. Their pricing is quite simple (TDR2.95% + Euro 0.25), account setup fee is nil. and their integration is fast and quick. Securionpay could be a perfect payment gateway for tech support in uk as they are based in Europe.

6 Soar Payments

They have a very personalised approach, they understand and cater to the unique needs of the high risk merchants and industries. SoarPay is headquartered in Houston, Texas. The company provides credit card processing services for businesses of all sizes. It has been rated as #1 High Risk Merchant Services Provider in 2015, and 2016.

SoarPay offers all-in-one merchant accounts include everything a high risk or offshore merchant needs to process successfully, including debit and credit card processing, check processing (ACH), payment gateways, and chargeback management services.

● Swiped Fees: 0.1 – 0.4% Plus Interchange + $0.15 per transaction

● Monthly Fees: $10 per month

Find their online application here.

7 PayPal

A lot of people aren’t aware of the fact that PayPal undertakes third party processing in the high risk business. It has various features that would help sort your problems of transaction and trust.

Features:

- Less Paperwork: Fill the application online and get it approved in minutes.

- Easy Online Application

- No set-up Fee

- Quick approval from all vendors

- No fixed monthly fees: The sales aren’t regular and so is the PayPal fee policy. You have to pay per transaction.

- High Fraud Protection Scheme

Payment Gateway for Tech Support in USA / UK

8 KDS Card Pay

They have risen to an esteemed and an efficient gateway that involves high risk. This is a protected method for initiating instalments with the utilisation of visas. This usage is processed as Mastercard points of interests which is further used by portals and clients, they can freely without any scrap of mistrust can process their instalments through it. They practice at giving seaward shipper account with support for awful credit and high hazard traders too. When you profit instalment passage for technical support business from us, you additionally get continuous online record details from them.

Why Choose them,

- Payment Through Master/Visa/Discover and so on.

- All currencies are acceptable.

- No holdback.

- 100% genuine gateway.

- No hidden policies.

- Quick integrations.

Their Services

- Customized payment gateway solution.

- Free easy integration quick approval.

- Accept all major activities.

- High level of transparency.

9 Instabill

Instabill provides solutions from Low Risk To High Risk, It has also provided customizable merchant accounts to E-Commerce, POS And MOTO businesses worldwide since 2001. Working With Domestic And International Acquiring Banks, they provide Merchants:

- Credit Card Processing

- Check Solutions

- Alternative Payment Solutions

- Now Accepting Bitcoin

- Offshore Merchant Accounts

- Multi-Currency Processing

- Fraud Protection

- 60-70% Revenue Sharing To ISOs & Agents

An excellent approach to payment gateways with,

- Generous revenue shares between 60-70 percent

- One dedicated account manager for your partnership

- Customized co-branded landing page and link

- Domestic high risk acquiring banks

- Proven offshore banking solutions

- Fast sign-up process

10 Merchant Solutions by The Trendy Media Group Inc.

They are a consulting firm and are established since 1995 whence they have consulted over a thousand firms. One of the well known high risk payment gateways in US and Canada, if you are looking for something like this, Merchant Solutions can be one of your best bets.

- Custom Solution for your Business

- Tailored Services for your Needs

- Dedicated Account Representative

- 99% Approval for Merchants

- Over 20 years of experience

- International and Domestic solutions

- Chargeback Protection Services

- High Volume Scalability

Set up fee: $ 5.000.00

Annual fee: $ 5.000.00

Pay out: Every day deducting a 10% holdback, which will be paid out after 6 month

11 IMS Payments

IMSinstantpay provides services to domestic and international merchants. They provide complete solutions for retail, eCommerce, mail order and high risk businesses with ACH eCheck processing. Their payment methods are Visa, MasterCard, Amex, JCB and ACH. Your country of residence is not a factor in securing a merchant account with IMSinstantpay.

High Risk ACH checking Accounts for International, United States and Canadian Merchants

- IMSinstantpay process electronic checks, guaranteed checks, web checks, check collections (delinquent ACH checks), and checks-by-phone.

- ACH checks for outbound/inbound telemarketing, mail/phone orders, catalogue sales, recurring billing, travel, tobacco-cigar/cigarettes, MLMs, pharmaceuticals/herbal, debt collections, and utility companies.

- International and Canadian merchants can process U.S. ACH checks.

- Unlimited ACH check volume.

- Underwriting requirements are less stringent than credit cards .

- Excellent ACH virtual terminal for single transactions, batch uploads and recurring billing for eCommerce merchants, API available as well.

- Iphone application and virtual terminal available for ACH transactions.

- Majority of American citizens have access to ACH through their saving and checking accounts.

eCheck payment gateway for tech support

The next big thing after paper check deposits is the e-check processing payment gateway. To be in lieu with the trends you might as well add the option of echeck payment gateway on your portal. It has a lot many advantages like

- Easy Approval

- Low Risk

- Less claim period- 30 days to 60 days in India and USA.

- Easy Integration

- Real time updates

- Direct settlement of payments in International Business Bank Accounts

12 BluePay Payment Gateway

BluePay is an excellent portal if you are looking for this upgradation, it provides you with the very highest levels of security; BluePay is a PCI-compliant company, offering features such as tokenization and P2PE, and we comply with PCI DSS standards to prevent eCheck and credit card fraud.

The above payment gateways excel in providing high risk support. They all have been the the play for a significant time now and have an immense experience of working with high risk merchants. They have a high positive reputation among the merchants and are considerably fair priced and have quality customer support. The best way that you can go about it is that you contact multiple providers and compare the pricings and listings of their respective service packages.

Stay safe, away from frauds and happy solutions to you!