In the world of internet, several transaction are happening online. Just like in the physical world such transactions involve exchange of money for purchase of goods and services. Unlike physical world if a customer decides to pass on money at the time of purchase she will need an online application that connects the transfer of money to the merchants account. That online application is known as payment gateway. In this article, I will get in detail and explain you what is payment gateway!!

Related Articles: How to Choose the Best Payment Gateway for Small Business

What is Payment Gateway?

Payment gateway is a merchant service provided by an e-commerce application service provider (Paypal, Instamojo, Stripe) that authorizes online money transactions. The online transaction may happen through credit card, debit card or direct bank transfers for online businesses, online retailers, corporates needing a transaction out there.

The payment may be provided by a bank (such as ICICI Bank, Chase Bank) to its customers, but can be provided by a specialised financial service providers (Paypal, Instamojo, Stripe) as a separate service, such as a payment service provider. PG supports the online payment transaction. It also transfer payment information from the merchants website to the banks server.

Payment gateway meaning in laymen terms

In laymen terms payment gateway is an online software that carries money digitally from one person to the other person in exchange of goods or service. Payment gateway is able to receive your authorisation to transfer money from your bank or credit card account to the sellers (merchants) bank account.

All payment gateways seek registration with banks (Such as Deutsche Bank or ICICI Bank, HSBC) or payment networks (Such as Visa, Mastercard or Amex) to authorise such transactions.

Payment gateways work like a carrier of money and to provide such services they charge transaction fee from the merchant who is doing such transactions.

Payment gateway meaning in hindi (हिंदी में भुगतान गेटवे का अर्थ)

लेमेन भाषा में भुगतान गेटवे एक ऑनलाइन सॉफ़्टवेयर है जो माल या सेवा के बदले में एक व्यक्ति से दूसरे व्यक्ति को डिजिटल रूप से पैसे लेता है। भुगतान गेटवे आपके बैंक या क्रेडिट कार्ड खाते से विक्रेताओं (व्यापारियों) बैंक खाते में धन हस्तांतरण करने के लिए आपके प्राधिकरण को प्राप्त करने में सक्षम है।

सभी भुगतान गेटवे ऐसे लेनदेन को अधिकृत करने के लिए बैंकों (जैसे ड्यूश बैंक या आईसीआईसीआई बैंक, एचएसबीसी) या भुगतान नेटवर्क (जैसे वीजा, मास्टरकार्ड या अमेक्स) के साथ पंजीकरण चाहते हैं।

भुगतान गेटवे पैसे के वाहक की तरह काम करते हैं और ऐसी सेवाएं प्रदान करने के लिए वे ऐसे लेनदेन कर रहे व्यापारी से लेनदेन शुल्क लेते हैं।

Online payment gateway meaning

Online payment gateway is the payment gateway’s that allow processing on transactions online. In principle all the payment gateways are online and transaction takes place online in all cases.

Different types of payment gateway

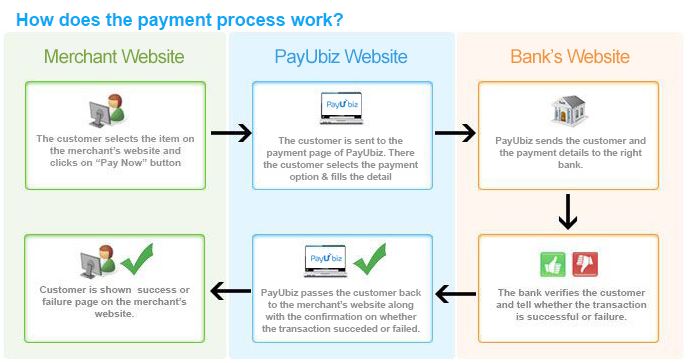

1 Hosted Payment Gateways

HPG directs your customer to the Payment Service Provider (PSP) page. This is where the customer enters their payment information and after payment is redirected back to the website to complete the checkout process. PayPal is one such payment gateway. HPG’s are secure, simple and customisable according to your needs. The only problem is that the whole user experience on the PSP page cannot be controlled by the merchant.

2 Self Hosted Payment Gateway

Payment details are confirmed within the merchant’s website. The collected data is then sent to the payment gateway URL. Some require a specific data set while some work with secret keys. It provides a good customer experience and can be controlled by the merchant to make it more user friendly. There is however no support system or a technical team to back it up when failed.

3 API Hosted Payment Gateways

In API hosted Payment Gateways, customers can enter their credit or debit card information directly on the merchant’s checkout page and payments are processed through an API (Application Programming Interface) or HTTPS queries. It is customisable and capable of all device integration. However merchants are responsible for securing and certification.

4 Local Bank Integration

These redirect the customer to the payment gateway’s bank website, wherein they enter their payment details and contact details. After the payment, the customer is redirected back to the merchant’s website with notification. Quick and easy really good for small businesses. However it is not ideal for wholesalers as they are usually no enabled returns or recurring payments.

Types of Payment Gateway in PHP

Some of them you should be knowing about,

– Authorise.Net

– PayPal

– SecurePay

– Instamojo

– CC Avenue

– EBS Payment Gateway

Related Articles: Top 10 Payment Gateways in India (2018) – Choose the Best

Types of payment gateway in India

In India you can get all types of payment gateways. On one hand you have companies like Instamojo who provides you hosted payment gateway, on the other hand you have companies like Amazon who works on self hosted payment gateway.

Types of Paypal payment gateway

Paypal is a global leader in payment gateways, it provides following types of payment gateway

- PayPal Standard: The simplest form of a payment gateway from Paypal. To use this payment gateway all you need to do is to enter your PayPal email address into the PayPal Settings section of your website. Once you have done that you can start selling with Easy Digital Downloads.

- PayPal Pro: This is a professional account from Paypal. If you are using this to process credit cards, you must have an SSL certificate. This service is available only in US, Canada, the UK, and Australia.

- PayPal Express: This is an extension to Paypal pro and used by businesses with an express payment processing button “Pay with Paypal”.

How Payment Gateway Works?

Like I shared before that I get several calls on a daily basis and most of the callers are not clear on how a Payment gateway works. They often confuse payment gateways with their bank account or POS terminals or several other things.

They often enquire why they need it and why can’t a consumer directly transfer money to their account.

Sometimes they confuse payment gateway with the eCommerce shopping cart or the merchant accounts they have on marketplaces such as Amazon or eBay.

Therefore, let us first understand the difference below:

Payment Gateway vs. POS terminal

In a nutshell, a payment gateway is designed for eCommerce merchants, and the transaction takes place online on a website or an App or over VOIP. ‘

Whereas POS (point-of-sale) terminals are used by an offline or brick-and-mortar business to accept payment from a customer.

Payment gateway vs. shopping cart

In an eCommerce transaction Payment gateways and shopping carts have a complementary role to play. However, both are not the same.

Shopping cart application allows a customer to choose a product and calculate the total cost inclusive of all applicable taxes. This allows a client to review her selection before she decides to pay through a payment gateway.

What it means is that shopping cart is essentially a virtual bag on an eCommerce site and payment gateway allows a customer to make the payment.

Payment gateway vs. Merchant account

A merchant account on Amazon or eBay is like a food outlet in a large food court with centralised payment facility. Therefore, on a merchant account, you do not handle or process money directly.

However, you might be responsible for handing over or shipping the product to a customer. The payment gateway on marketplaces such as Amazon or eBay is managed directly by marketplaces.

However, in the case of an eCommerce site with payment gateway, a merchant would be directly managing customers payment.

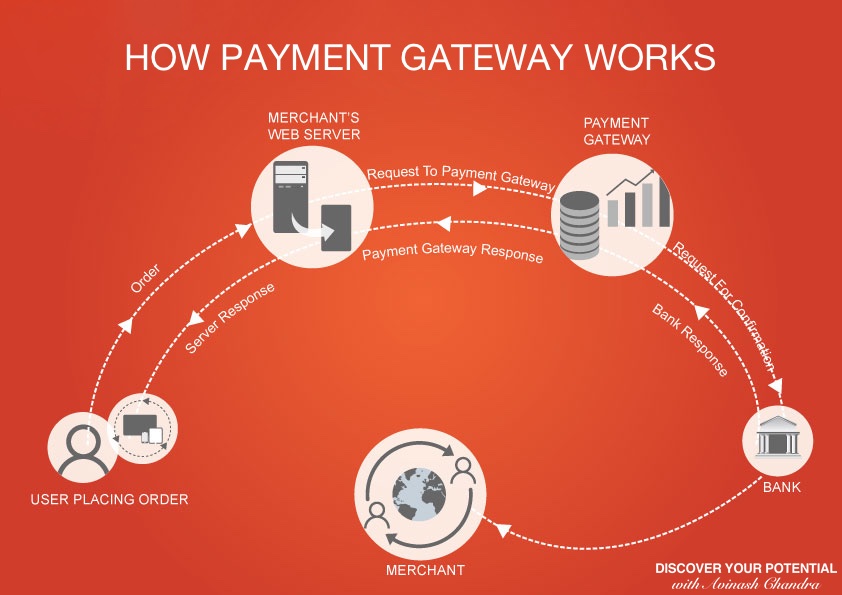

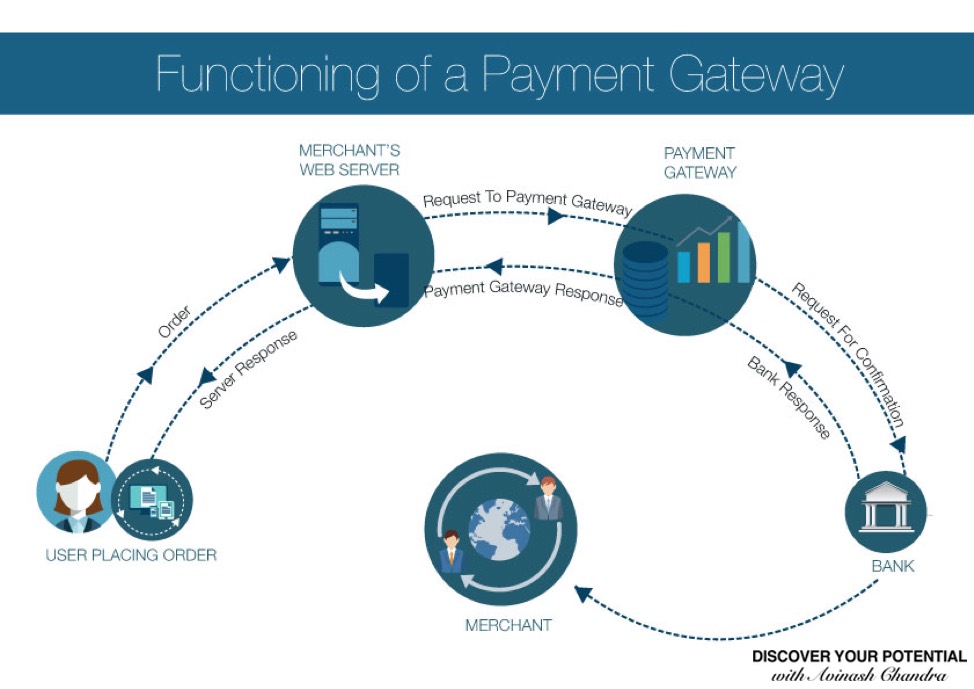

- Step 1: A customer places an order first by clicking on the host website’s ‘Submit Order’ or similar to that button.

- Step 2: If the website where these orders is being placed has SSL certification then the customer’s web browser encrypts the information being sent to the merchant’s web-server. Otherwise the information is prone to hacking.

- Step 3: The transaction details is then forwarded to their payment gateway by the merchant. Generally this is also an encrypted connection between server of the merchant and the payment gateway server.

- Step 4: The message is then converted from XML to a format understood by EFT Switches, by the payment gateway. It is then forwarded to the payment processor used by the merchant’s acquiring bank.

- Step 5. The transaction information is then forwarded by the payment processor to the card association. Some Cards also act as issuing bank and directly provide a response of approval or decline. Otherwise the card association routes the transaction to the correct card issuing bank.

- Step 6: The credit card issuing bank receives the authorization request verifies the transaction and then sends the response back to the processor with a response code of either approved or denied. In addition to this, the response code is also used to define if and why the transaction failed.

- Step 7: The processor forwards the authorization response further to the payment gateway.

- Step 8: The payment gateway receives the response and forwards it to the website where it is interpreted as a relevant response. Once it is , thereafter is relayed back to the merchant and the cardholder. This is called Authorization or ‘auth’. The entire process takes no more than 5 seconds.

- Step 9: The merchants web server then completes the transaction. The process can be repeated, this time to clear the authorization by completing the transaction. This results in the issuing bank clearing the ‘auth’ and prepares to settle with the merchant acquiring bank.

- Step 10: At the end of the day merchant submits all the approved authorisations in a batch, to their acquiring bank for settlement via its processor. This typically reduces the corresponding ‘auth’ if not cleared.

- Step 11: Request is made to the credit card issuer for settlement which is paid by the holder to the acquiring bank.

- Step 12: Then the acquiring bank submits all the funds into merchant’s bank account. The entire process from payment authorisation to settlement can take upto 3 days.

Related Post: How to choose best payment gateway for small business

What is Payment Gateway Integration?

Payment gateway integration is the process of connecting a payment gateway with a website or mobile application. Once the integration is complete a user is able to place an order online on a merchants website/mobile app without any human assistance.

Therefore, payment gateway integration allows a payment gateway to:

- Receive merchants credentials, who is selling gods or service to a consumer

- Receive order, customer and payment details

- Connect with the customers bank to seek authorisation for the transaction

- Process the transaction online without any manual intervention.

How to integrate payment gateway in website

If you are a small business and starting to create your new eCommerce store, ask your website developer about the CMS (Content Management system) he is going to use. Enquire about the payment gateway integration plugins available for the theme.

Most of the popular CMS such as WordPress or Magento or Prestashop have a ready plugin available generally from the payment gateways itself.

For example Instamojo offers plugins for several CMS systems:

Similarly EBS payment gateway has created integrations for has several popular shopping carts such as Magento, Zencart, Opencart, Tomatocart, WordPress woo-commerce etc.

How to integrate payment gateway in php

You can integrate payment gateway in php with the payment gateway API. Check with the payment gateway of your choice for the API’s and then your developer should easily be able to connect the two.

How to integrate payment gateway in android application

You can integrate payment gateway in android application with SDK kit . Check with the payment gateway of your choice for the kit and then your developer should easily be able to connect the two.

what is payment gateway charges

For any transaction payment gateway charge as follows:

- Setup fees

- Annual Maintenance Charges

- TDRs (Transfer Development Right): TDR is a portion of every transaction made on any payment gateway. This portion goes to the payment gateway for providing the payment processing services. These charges are paid by the merchant. It usually lies in between 1% to 7%, depending on the Payment gateway you choose.

Secure payment gateway?

You must choose a secure payment gateway.

SSL

You must keep in mind that all your transactions must be secured by SSL protocol. This helps to encrypt the information. Encrypting information further helps in protecting all your sensitive data. It improves payment security and helps set the customer mind to buy more.

PCI

PCI or Payment Card Industry Data Security Standards (PCI DSS) provides guidelines to the merchants. These guidelines tell merchant what they have to do in order to secure sensitive data in payment processes.

Tokenization

It must be thoroughly kept in mind that you shouldn’t ever store your customer’s credit and debit card information. Customer’s data doesn’t touch your servers, they are encrypted even before it is stored on database servers. The risk of data breach is reduced as Tokenisation replaces sensitive data with random characters.

3D Secure

This is an important security patch that helps prevent many kinds of frauds in debit and credit card transaction. Everytime a transaction occurs, an additional password protection is confirmed.

Choose your payment gateway according to your need quotient!

FAQ’s

Q1 what is the meaning of payment gateway?

Payment gateway is a merchant service provided by an e-commerce application service provider (Paypal, Instamojo, Stripe) that authorizes online money transactions. The online transaction may happen through credit card, debit card or direct bank transfers for online businesses, online retailers, corporates needing a transaction out there.

Q2 How to integrate instamojo payment gateway in wordpress?

The easiest way to integrate Instamojo with your wordpress site is to use the plugin provided by the payment gateway itself.

Q3 How to integrate payu payment gateway in wordpress?

The easiest way to integrate payu with your wordpress site is to use the plugin provided by the payment gateway itself.

Q4 How to integrate payment gateway in woocommerce?

The easiest way to integrate payment gateway with your wordpress site is to use the plugin provided by the payment gateway itself.

Q5 How to integrate payment gateway in php ccavenue?

The easiest way to integrate CCavenue with your php site is to use the api provided by the payment gateway itself.

Q6 How to integrate payumoney payment gateway in php?

The easiest way to integrate payumoney with your php site is to use the api provided by the payment gateway itself.

Q7 How to add payment gateway in website?

If you are a small business and starting to create your new eCommerce store, ask your website developer about the CMS (Content Management system) he is going to use. Enquire about the payment gateway integration plugins available for the theme.

Most of the popular CMS such as WordPress or Magento or Prestashop have a ready plugin available generally from the payment gateways itself.

Q8 How to get payment gateway?

If you are looking for a payment gateway for your online business, here is how you need to go about it:

- Choose the payment gateway which can integrate well with your website.

- You can consider our list of top 10 payment gateways in India.

- Connect with a payment gateway integrator, who can provide you assistance with the integration.

- Depending on the payment gateway, they may ask for the following documents, keep it ready.

- Certificate of incorporation or partnership deed.

- Registration with tax authorities

- Address proof

- Once you have provided all the documents, depending on risk profile payment gateway may or may not provide you the payment gateway.

Q9 How does payment gateway work?

Payment gateway works in the following manner:

- Step 1: A customer places an order first by clicking on the host website’s ‘Submit Order’ or a similar button.

- Step 2: If the website where these orders is being placed has SSL certification then the customer’s web browser encrypts the information being sent to the merchant’s web-server. Otherwise the information is prone to hacking.

- Step 3: The transaction details is then forwarded to their payment gateway by the merchant. Generally this is also an encrypted connection between server of the merchant and the payment gateway server.

- Step 4: The message is then converted from XML to a format understood by EFT Switches, by the payment gateway. It is then forwarded to the payment processor used by the merchant’s acquiring bank.

- Step 5. The transaction information is then forwarded by the payment processor to the card association. Some Cards also act as issuing bank and directly provide a response of approval or decline. Otherwise the card association routes the transaction to the correct card issuing bank.

- Step 6: The credit card issuing bank receives the authorization request verifies the transaction and then sends the response back to the processor with a response code of either approved or denied. In addition to this, the response code is also used to define if and why the transaction failed.

- Step 7: The processor forwards the authorization response further to the payment gateway.

- Step 8: The gateway receives the response and forwards to the website where it is interpreted as a relevant response, thereafter is relayed back to the merchant and the cardholder. This is called Authorization or ‘auth’. The entire process takes no more than 5 seconds.

- Step 9: The merchants web server then completes the transaction. The process can be repeated, this time to clear the authorization by completing the transaction. This results in the issuing bank clearing the ‘auth’ and prepares to settle with the merchant acquiring bank.

- Step 10: At the end of the day merchant submits all the approved authorisations in a batch, to their acquiring bank for settlement via its processor. This typically reduces the corresponding ‘auth’ if not cleared.

- Step 11: Request is made to the credit card issuer for settlement which is paid by the holder to the acquiring bank.

- Step 12: Then the acquiring bank submits all the funds into merchant’s bank account. The entire process from payment authorisation to settlement can take upto 3 days.

Q10 What is tdr in payment gateway?

TDR is a portion of every transaction made on any payment gateway. This portion goes to the payment gateway for providing the payment processing services. These charges are paid by the merchant. It usually lies in between 1% to 7%, depending on the Payment gateway you choose.

Q11 How does Payment Gateway works?

Below is the detailed description of how payment gateway works.

- eCommerce customer chooses the product or service she wishes to buy.

- She fills out the credit card of debit card information on the eCommerce store on the payment information page before checkout.

- The payment gateway on the eCommerce store collects the payment information, encrypts it and sends it securely to card issuing network (Visa or Mastercard or Amex or Discover card) for authorisation.

- The card issuing network sends the request to the card issuing bank.

- The card issuer approves or declines the transaction and sends its response, through Visa or MasterCard, to the payment gateway.

- The payment gateway informs the merchant who completes the transaction accordingly.

- In the case of an approved transaction, the card issuer debits the cardholder’s account and transfers the money to payment gateway through processing network.

- The payment gateway credits the connected merchant bank accounts with the received payment.

- The card issuing bank posts the transaction to the cardholder’s account and requests payment in the monthly billing cycle.